Basic Views on Corporate Governance

Loadstar Capital K. K. aims to enhance its corporate value over the long term by ensuring soundness of management, transparency, and compliance. To this end, Loadstar recognizes that it is vital to build an organization that can promptly and flexibly address changes in the business environment, with the aim of enhancing corporate governance. As such, Loadstar conducts business efficiently considering shareholders' value.

-

Corporate Governance Report

(408KB)

Corporate Governance Report

(408KB)

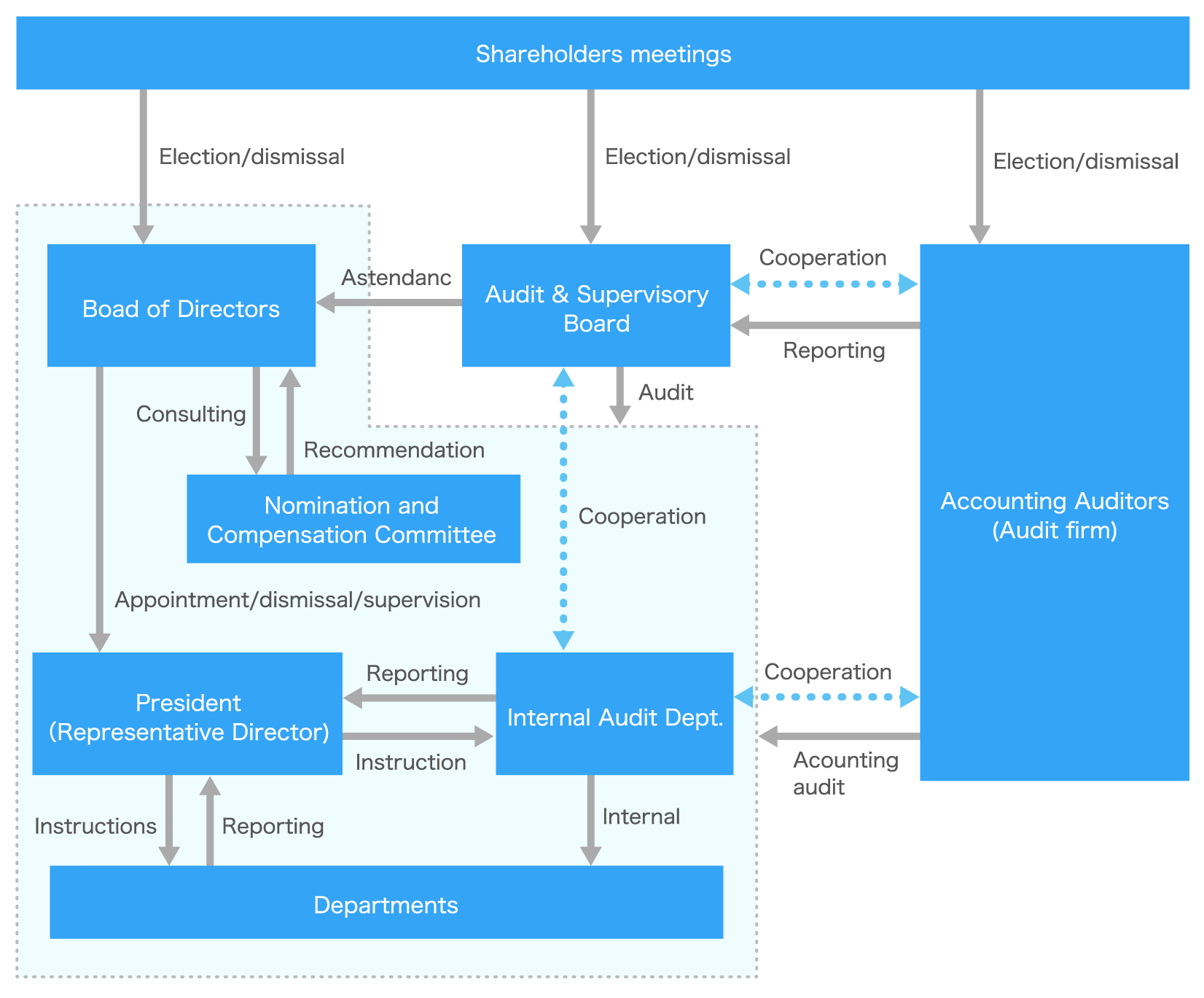

The Board of Directors currently consists of three Internal Directors and three Outside Directors who are also Independent Directors. The Board of Directors is chaired by the President. The Board decides important matters of the Company and supervises the execution of duties by directors.

In addition, Audit & Supervisory Board Members attend the Board of Directors meetings and express their opinions when needed.

We analyze and evaluate the effectiveness of the Board of Directors as a whole, and the results are included in the Corporate Governance Report.

The Audit & Supervisory Board currently consists of one full-time Audit & Supervisory Board Member and two outside Audit & Supervisory Board Members who are Independent Officers. The Audit & Supervisory Board is chaired by the full-time Audit & Supervisory Board Member, and they resolve the audit policy, assignment of duties, and other related matters. They also receive reports from each Audit & Supervisory Board Member on matters related to audits that have been conducted in accordance with the audit policy and assignment of duties and hold discussions on such matters. In addition, we have established the Internal Audit Department that serves as a specialized body to assist the duties of the Audit & Supervisory Board Members.

The Nomination and Compensation Committee currently consists of one Internal Director and three Outside Directors. The chairperson of the Committee is selected from among the Outside Directors. The Board of Directors consults with the Committee when making resolutions on matters related to the compensation and selection and dismissal of directors, and the Committee deliberates on the content of the consultation and reports back to the Board of Directors.

Loadstar will be audited by Grant Thornton Taiyo LLC for auditing accounting matters from fiscal year 2025. There is no conflict of interest between the audit firm and the executive officers of the audit firm who are engaged in the audit of the Company.

The Group recognizes that it is the management's responsibility to maintain an internal control system that enables sound and appropriate execution of businesses. Therefore, the Group has established a management system, led by the Company, to manage various major risks associated with the Group's business. This system ensures the effectiveness and efficiency of operations, the reliability of financial reporting, compliance with laws and regulations that pertain to business activities, and the protection of assets.

We recognize that the value of the Group is enhanced through the establishment of a sound and efficient internal control system. Based on this belief, we have placed internal audits as an important function of the internal control system, and the Internal Audit Department, independent from other departments, verifies the internal control system.

Please look at the Annual Securities Report for our basic views and the status of the internal control system.

|

Name |

Position |

Reason for appointment and Attendance at Board of Directors meeting |

|---|

Tatsushi Iwano (Date of birth 1973) |

President, Loadstar Capital K.K. |

He is a certified real estate appraiser and has extensive experience and achievements in the real estate investment market. He has been at the helm of the Company since its foundation and has led the Company's growth. Based on this, he is appointed as a director for the further growth of the Company. Attendance at Board of Directors meetings: 100% |

Naoyuki Kubo (Date of birth 1973) |

Director, Loadstar Capital K.K. |

He is a certified real estate appraiser in Japan and overseas and has extensive knowledge in real estate appraisal. He has been in charge of sourcing, disposition and sales activities of the Company since the early days of the Company's establishment and has made a significant contribution to the Company's performance. Starting in January 2025, he will spearhead Loadstar Investments K.K. as President. Based on this, he is appointed as a director for the further development of the Company. Attendance at Board of Directors meetings: 100% |

Takuya Kawabata (Date of birth 1983) |

Director, Loadstar Capital K.K. |

He is a certified public accountant and has a high degree of knowledge and experience in accounting and finance. At the Company, he serves as Chief Financial Officer. Based on this, he is appointed as a director for the further development of the Company. Attendance at Board of Directors meetings: 100% |

|

Hideo Wanami (Date of birth 1952) |

Director (Independent outside director), Loadstar Capital K.K. |

He served in various important positions at the National Tax Administration Bureau, and as a certified tax accountant, he is well versed in finance and accounting. Although he does not have corporate management experience, he has provided support for corporate management from an advisory perspective. He provides fair, impartial, and beneficial comments at the Board of Directors meetings. Based on this, he is appointed as a director (Independent outside director) for the further development of the Company. Attendance at Board of Directors meetings: 100% |

Jun Onishi |

Director (Independent outside director), Loadstar Capital K.K. |

He is an attorney at law and real estate appraiser and has knowledge and experience in real estate related legal affairs and real estate appraisal. He also has experience in running his own law/real estate appraisal firm. Based on this, he is appointed as a director (Independent outside director) for the further development of the Company. Attendance at Board of Directors meetings: 100% |

Mayumi Funaki (Date of birth 1978) |

Director (Independent outside director), Loadstar Capital K.K. |

She has extensive experience in public relations (“PR”) and has supported PR activities for several hundred companies. She has a diverse range of perspectives and expertise in corporate communications. As a corporate senior executive, she also has a broader insight into overall management. With her profound insight into societal events, she demonstrates excellent planning and execution skills to resolve issues. Based on this, she is appointed as a director for the further development of the Company. Attendance at Board of Directors meetings: 100% |

Note 1: In addition to the requirements of the Companies Act, the Company appoints Outside Directors who are independent from the Company in accordance with the independence standards stipulated by the Tokyo Stock Exchange.

Note 2: Specialization and Experience of Directors (Skills Matrix)

|

(NOTE) Reasons for selecting the above competencies.

- Corporate management:

We are committed to our mission: "Real Estate x Tech to Open Up a New Market." We believe that corporate management skills are critical to respond quickly to changes in the business environment and to devise the Company's long-term growth strategy. - Real estate business:

We believe that our knowledge, experience, and network in real estate are the core skills that are fundamental to all our businesses and necessary to drive our business forward. - ICT Digital (Real Estate Tech):

We are striving to bring about innovation in the real estate industry through the power of technology. To achieve this goal, knowledge of ICT digital, especially real estate technology, is important. Therefore, we believe that ICT Digital (Real Estate Tech) is also a key competency. - International business:

Tokyo, our main investment area, is a key market for global investing. We believe that knowledge of international business, including experience in structuring investment vehicles for overseas investors, is a necessary competency. - ESG/SDGs:

With this competency, we believe that we can achieve sustainable growth for the Company as we endeavor to solve social problems through our business and create a work environment in which all our executives and employees can work enthusiastically and pursue personal goals. - Legal affairs and compliance:

We believe that this competency is essential because the establishment of an appropriate governance system is the foundation for enhancing corporate value and the Board of Directors needs to fulfill its duties. - Finance, accounting and tax:

We believe that this competency is essential to strengthen our financial base from a medium- to long-term perspective, facing the capital markets, and to develop financial strategies based on our business strategy and shareholder return policy.

|

Name |

Position |

Reason for appointment and Attendance at the Audit & Supervisory Board |

|

Atsushi Tanaka (Date of birth 1952) |

Audit & Supervisory Board Member, Loadstar Capital K.K. |

He has extensive practical experience in corporate management, real estate transactions and debt collection. He is appointed as an Audit & Supervisory Board Member so that he can utilize his expertise and wealth of experience in auditing the Company's decision-making and business execution, thus auditing the Company's management in order to continuously improve the Company's corporate value. Attendance at Audit & Supervisory meetings: 100% |

|

Yoshiaki Ueno |

Audit & Supervisory Board Member, Loadstar Capital K.K. |

He is a certified public accountant. He served as Chief Financial Officer at several financial institutions and as a director of a subsidiary company. He also has experience as an outside auditor at several companies. He is appointed as an Audit & Supervisory Board Member so that he can audit the Company's management for the purpose of enhancing the sustained growth of the Company's corporate value. Attendance at Audit & Supervisory meetings: 100% |

|

Ryoko Kawaguchi |

Audit & Supervisory Board Member, Loadstar Capital K.K. |

As an attorney at law, she has a wide range of experience and expertise in corporate legal affairs, including corporate law, business contracts, intellectual property, and labor relations. She also possesses experience as an Audit & Supervisory Board Member at another company. She is appointed as an Audit & Supervisory Board Member to audit the Company's management for the purpose of enhancing the sustained growth of the Company's corporate value. Attendance at Audit & Supervisory meetings: 100% |

①Directors

Matters relating to decisions regarding details of compensation for individual directors

At a meeting held on February 18, 2025, the Company’s Board of Directors passed a resolution to approve a policy to determine compensation for individual directors. The Board of Directors consults with the Nomination and Compensation Committee on the details of the resolution in advance and receives a report from the Committee. In addition, the Board of Directors has confirmed that the method of determining the details of compensation for each director for the fiscal year and the details of compensation, which was determined by the Board of Directors, are in line with the decision-making policy resolved by the Board of Directors. The Board of Directors has also confirmed that the report from the Nomination and Compensation Committee has been respected and is in line with such policy. An overview of this policy for determining the details of compensation for individual directors is provided below in a., b., c., and d.

a. 1) Performance-linked compensation: None

2) Non-monetary compensation: Restricted stock shall be granted to directors, excluding Outside Directors, for the purpose of providing incentives to sustainably increase the Company's corporate value and to drive further shared value with shareholders. Pursuant to the provisions of the allotment agreement for shares with transfer restrictions, which has been concluded between the Company and the directors, the Company shall take back any shares, for free, that have not yet been released from restrictions on transfer.

The number of shares to be allotted to each director shall, in principle, be determined by the Board of Directors upon deliberation and report by the Nomination and Compensation Committee. The Board of Directors shall take into consideration each director's contribution, the Company's performance, expectations of future contributions, and other factors in a comprehensive manner. The maximum number of shares to be allotted to all directors and the maximum total amount shall be no more than 60,000 shares per year and within 200 million yen annually.

3) Amount or calculation method of compensation other than the above 1) and 2): The amount of compensation for each director shall, in principle, be determined by the Board of Directors upon deliberation and report by the Nomination and Compensation Committee. The Board of Directors shall take into consideration each director's contribution, the Company's performance, expectations of future contributions, and other factors in a comprehensive manner. The total amount of compensation for all directors shall fall within the total amount). of compensation approved at the 7th Annual General Meeting of Shareholders on March 28, 2019, which is an annual monetary compensation of 100 million yen plus an amount equivalent to 5% of consolidated profit before income taxes for the previous fiscal year (including no more than 20 million yen for Outside Directors.

4) Ratio of 1), 2) and 3): In principle, the Board of Directors shall resolve how much 1), 2), and 3) are to be paid to each director upon deliberation and report by the Nomination and Compensation Committee. The Board of Directors shall take into consideration each director's contribution, the Company's performance, expectations of future contributions, and other factors comprehensively.

b. Policy on timing and conditions for granting of compensation to directors:

a. 2) Paid annually

a. 3) Paid monthly during director's term of office

c. Decision-making procedure when the Company delegates the decision on the details of compensation to directors or other third parties: As a rule, the Board of Directors shall resolve the compensation matter following deliberation and report by the Nomination and Compensation Committee, and shall not delegate it to any other parties.

d. Other significant matters concerning the determination of the details of each director’s compensation: None.

②Audit & Supervisory Board Member

The Company and the Audit & Supervisory Board have not set a policy for determining the calculation method for compensation for the Audit & Supervisory Board Members. An Extraordinary General Meeting of Shareholders held on June 15, 2017 determined that compensation for the three Audit & Supervisory Board Members shall be monetary compensation of up to 30 million yen per annum. Accordingly, compensation for Audit & Supervisory Board Members is determined, as a fixed salary not exceeding 30 million yen per annum, at the discretion of the full-time Audit & Supervisory Board member following deliberations by the Audit & Supervisory Board.

The Company recognizes that complying with laws and regulations is one of the most important management issues for directors and employees in the course of conducting their duties. In order to strengthen the awareness of compliance among all directors and employees of the Company, the Company has established an organizational structure and operating procedures to ensure smooth and effective implementation of compliance. By doing so, we are striving to maintain the fairness and soundness of our businesses and to enhance the trust of our clients.

Whistle-blowing system

The Company has established a whistle-blowing system to make sure that the Company handles inquiries and reports from directors and employees concerning violations of laws and regulations or the Company's internal rules, either on an organizational or individual basis. By establishing internal and external hotlines, the Company endeavors to detect and correct any misconduct at an early stage, thereby reinforcing compliance management.

The Group considers increasing information security risks, which are becoming more critical day by day, to be an important management issue. The Risk Management Committee discusses information security risks and reports the results to the Board of Directors. At the same time, Audit & Supervisory Board Members and the Internal Audit Department carry out monitoring. Under this system, we take measures for information security on a daily basis in order to protect internal and external information, including personal information. We also receive reviews by an external assessment organization.