Medium-Term Management Plan

The Loadstar Group has formulated a Medium-Term Management Plan with the fiscal year ending December 2027 as its final year.

■Loadstar Group's Management Philosophy

The Group has established the following Mission, Vision, and Values:

Based on the above philosophy, the Group operates in the real estate investment domain (Corporate Funding Business and Asset Management Business) and the Fintech domain (Crowdfunding Business).

The strength of our group lies in the fusion of real estate investment expertise and IT. We aim to create new markets in the real estate industry, which is said to be lagging behind in IT adoption.

Specifically, we have established a real estate-focused crowdfunding service via the Internet, and are also challenging to create a secondary market for real estate investments using blockchain technology and a real estate investment market that does not rely on financial institutions.

Furthermore, the Group is actively working towards realizing a sustainable society, aiming to enhance stakeholder benefits and increase our long-term corporate value.

■Basic Policy of the Medium-Term Management Plan

The basic policies of the Medium-Term Management Plan are as follows.

The name "Loadstar" in Loadstar Capital K.K. means a star that continues to shine at a fixed point, like the North Star. In the real estate industry, where market fluctuations are large, our Group aspires to continue shining as a guiding light.

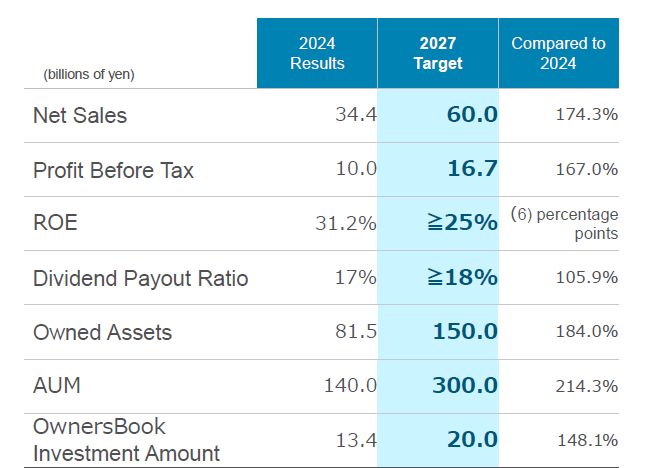

■KPI

For the consolidated fiscal year ending December 2027, we are targeting consolidated net sales of 60 billion yen (a 74% increase from the fiscal year ending December 2024) and consolidated income before income taxes of 16.7 billion yen (a 67% increase).

We aim to expand the scale of all our businesses, and we also plan to increase our own assets and Assets Under Management (AUM) in our Asset Management (AM) business. While expanding our business while managing risks is challenging, all officers and employees are committed to working diligently towards achieving our plans.

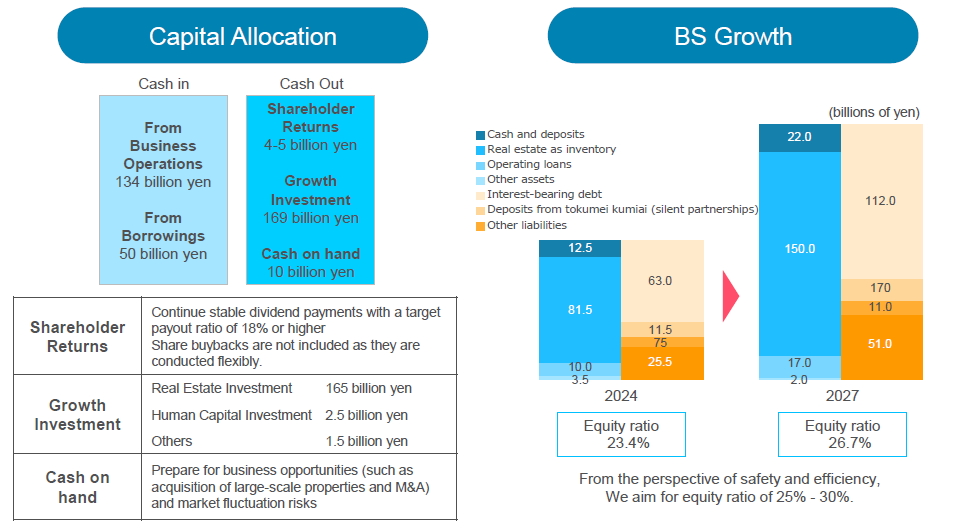

■Growth Investment

As we consider our Group to be in a growth phase, we plan to use the majority of the cash generated from our operations for growth investments. While these growth investments will primarily focus on real estate, we will also actively invest in human capital.

In addition, we will continue to implement stable and consistent dividends as a form of shareholder return.

In addition, as we grow, our balance sheet (BS) will also expand. However, from the perspective of safety and efficiency, we intend to conduct our business while paying attention to our equity ratio.

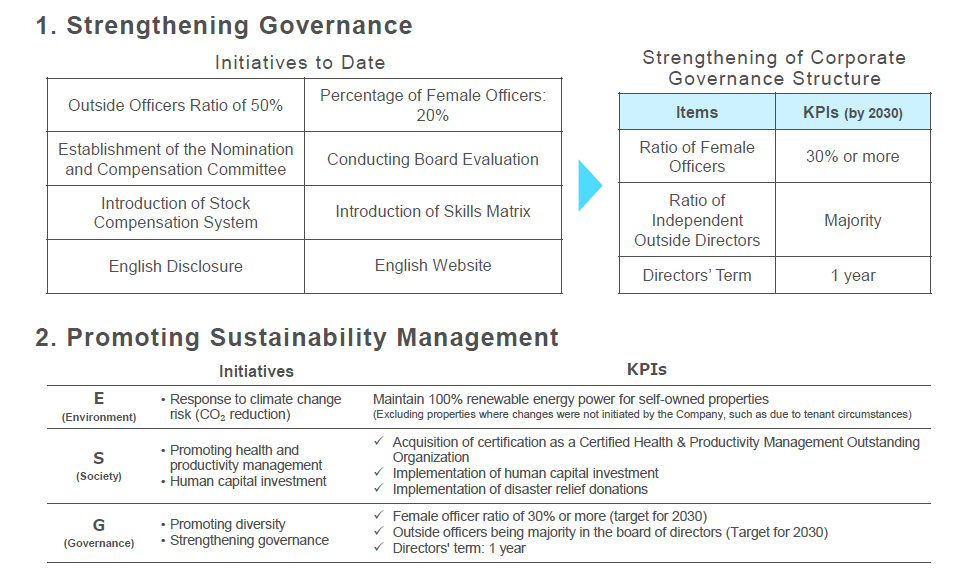

■Corporate Governance

The Company believes that enhancing management soundness, transparency, and compliance will increase corporate value over the long term, and we will continue to work on strengthening governance.

Furthermore, we aim to contribute to sustainable economic and social development through our business activities, fulfilling our social responsibilities in the areas of Environment, Social, and Governance, and realizing an increase in corporate value and shareholder value.